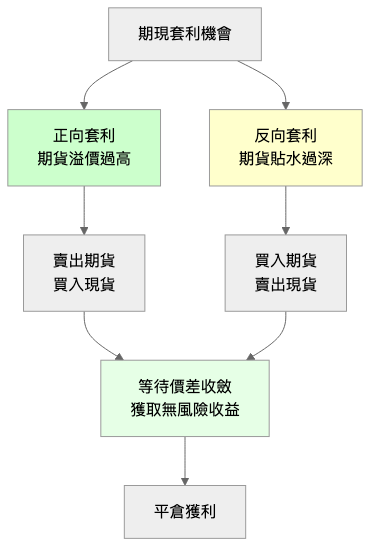

今天我們要深入學習期現套利策略的實際應用,這就像爸爸發現同樣的農產品在不同市場有價格差異時的套利行為。早上在產地收購便宜的蔬菜,下午到城裡的高檔超市賣出,賺取價差!期現套利也是類似的概念,利用現貨和期貨間的價格差異獲利。

期貨理論價格公式:

F = S × e^(r-q)T

其中:

import asyncio

import pandas as pd

import numpy as np

from datetime import datetime, timedelta

import logging

class BasisMonitor:

"""基差監控系統"""

def __init__(self, symbols=['BTCUSDT'], entry_threshold=0.005, exit_threshold=0.002):

self.symbols = symbols

self.entry_threshold = entry_threshold # 0.5% 進場閾值

self.exit_threshold = exit_threshold # 0.2% 出場閾值

self.basis_history = {symbol: [] for symbol in symbols}

self.current_positions = {}

async def calculate_basis(self, spot_price, futures_price, funding_rate=0):

"""計算基差和年化收益率"""

# 基差(絕對值)

basis = futures_price - spot_price

# 基差率(相對值)

basis_rate = basis / spot_price

# 考慮資金費率的年化收益

# 假設8小時收取一次資金費率

annual_funding_cost = funding_rate * 3 * 365 # 每日3次 × 365天

# 調整後的套利收益

adjusted_basis_rate = basis_rate - annual_funding_cost

return {

'basis': basis,

'basis_rate': basis_rate,

'adjusted_basis_rate': adjusted_basis_rate,

'funding_rate': funding_rate,

'annual_funding_cost': annual_funding_cost

}

async def identify_arbitrage_opportunity(self, symbol, spot_data, futures_data):

"""識別套利機會"""

spot_price = spot_data['price']

futures_price = futures_data['price']

funding_rate = futures_data.get('funding_rate', 0)

basis_info = await self.calculate_basis(spot_price, futures_price, funding_rate)

# 記錄歷史基差

basis_record = {

'timestamp': datetime.now(),

'spot_price': spot_price,

'futures_price': futures_price,

'basis': basis_info['basis'],

'basis_rate': basis_info['basis_rate'],

'adjusted_basis_rate': basis_info['adjusted_basis_rate'],

'funding_rate': funding_rate

}

self.basis_history[symbol].append(basis_record)

# 保持最近1000筆記錄

if len(self.basis_history[symbol]) > 1000:

self.basis_history[symbol] = self.basis_history[symbol][-1000:]

# 判斷套利機會

opportunity = None

adjusted_rate = basis_info['adjusted_basis_rate']

if adjusted_rate > self.entry_threshold:

# 正向套利:期貨溢價過高

opportunity = {

'type': 'positive_arbitrage',

'action': 'sell_futures_buy_spot',

'expected_return': adjusted_rate,

'spot_action': 'buy',

'futures_action': 'sell',

'confidence': min(adjusted_rate / self.entry_threshold, 3.0)

}

elif adjusted_rate < -self.entry_threshold:

# 反向套利:期貨貼水過深

opportunity = {

'type': 'negative_arbitrage',

'action': 'buy_futures_sell_spot',

'expected_return': abs(adjusted_rate),

'spot_action': 'sell',

'futures_action': 'buy',

'confidence': min(abs(adjusted_rate) / self.entry_threshold, 3.0)

}

elif symbol in self.current_positions and abs(adjusted_rate) < self.exit_threshold:

# 平倉機會:基差收斂

opportunity = {

'type': 'close_arbitrage',

'action': 'close_position',

'expected_return': self.current_positions[symbol]['unrealized_pnl'],

'confidence': 1.0

}

return opportunity, basis_info

def get_basis_statistics(self, symbol, lookback_days=30):

"""獲取基差統計資訊"""

if symbol not in self.basis_history or not self.basis_history[symbol]:

return None

# 獲取最近N天的數據

cutoff_time = datetime.now() - timedelta(days=lookback_days)

recent_data = [

record for record in self.basis_history[symbol]

if record['timestamp'] > cutoff_time

]

if not recent_data:

return None

basis_rates = [record['basis_rate'] for record in recent_data]

adjusted_rates = [record['adjusted_basis_rate'] for record in recent_data]

stats = {

'mean_basis_rate': np.mean(basis_rates),

'std_basis_rate': np.std(basis_rates),

'mean_adjusted_rate': np.mean(adjusted_rates),

'std_adjusted_rate': np.std(adjusted_rates),

'min_basis_rate': np.min(basis_rates),

'max_basis_rate': np.max(basis_rates),

'percentile_25': np.percentile(basis_rates, 25),

'percentile_75': np.percentile(basis_rates, 75),

'samples_count': len(recent_data)

}

return stats

class ArbitrageStrategy:

"""期現套利策略"""

def __init__(self, initial_capital=100000):

self.initial_capital = initial_capital

self.available_capital = initial_capital

self.positions = {}

self.trade_history = []

self.basis_monitor = BasisMonitor()

async def execute_arbitrage(self, symbol, opportunity, spot_price, futures_price):

"""執行套利策略"""

if opportunity['type'] in ['positive_arbitrage', 'negative_arbitrage']:

return await self._open_arbitrage_position(

symbol, opportunity, spot_price, futures_price

)

elif opportunity['type'] == 'close_arbitrage':

return await self._close_arbitrage_position(symbol, spot_price, futures_price)

async def _open_arbitrage_position(self, symbol, opportunity, spot_price, futures_price):

"""開啟套利倉位"""

# 計算倉位大小(使用20%的可用資金)

position_capital = self.available_capital * 0.2

# 基於期望收益調整倉位大小

confidence_multiplier = min(opportunity['confidence'], 2.0)

adjusted_capital = position_capital * confidence_multiplier

spot_quantity = adjusted_capital / spot_price

futures_quantity = spot_quantity # 等量對沖

# 檢查資金是否足夠

required_capital = spot_quantity * spot_price

if required_capital > self.available_capital:

return False, "資金不足"

# 模擬交易執行

spot_commission = spot_quantity * spot_price * 0.001 # 0.1% 手續費

futures_margin = futures_quantity * futures_price * 0.1 # 10倍槓桿,10%保證金

futures_commission = futures_quantity * futures_price * 0.0004 # 0.04% 手續費

total_cost = required_capital + spot_commission + futures_margin + futures_commission

if total_cost > self.available_capital:

return False, "總成本超過可用資金"

# 更新倉位

position = {

'symbol': symbol,

'type': opportunity['type'],

'entry_time': datetime.now(),

'spot_quantity': spot_quantity,

'futures_quantity': futures_quantity,

'spot_entry_price': spot_price,

'futures_entry_price': futures_price,

'spot_action': opportunity['spot_action'],

'futures_action': opportunity['futures_action'],

'expected_return': opportunity['expected_return'],

'total_cost': total_cost,

'spot_commission': spot_commission,

'futures_commission': futures_commission,

'futures_margin': futures_margin

}

self.positions[symbol] = position

self.available_capital -= total_cost

# 記錄交易

trade_record = {

'timestamp': datetime.now(),

'action': 'open_arbitrage',

'symbol': symbol,

'type': opportunity['type'],

'spot_price': spot_price,

'futures_price': futures_price,

'quantity': spot_quantity,

'expected_return': opportunity['expected_return'],

'total_cost': total_cost

}

self.trade_history.append(trade_record)

return True, f"成功開啟 {symbol} 套利倉位"

async def _close_arbitrage_position(self, symbol, spot_price, futures_price):

"""平倉套利倉位"""

if symbol not in self.positions:

return False, "無對應套利倉位"

position = self.positions[symbol]

# 計算損益

spot_pnl = 0

futures_pnl = 0

if position['spot_action'] == 'buy':

# 現貨做多,現在賣出

spot_pnl = position['spot_quantity'] * (spot_price - position['spot_entry_price'])

else:

# 現貨做空,現在買入

spot_pnl = position['spot_quantity'] * (position['spot_entry_price'] - spot_price)

if position['futures_action'] == 'sell':

# 期貨做空,現在買入平倉

futures_pnl = position['futures_quantity'] * (position['futures_entry_price'] - futures_price)

else:

# 期貨做多,現在賣出平倉

futures_pnl = position['futures_quantity'] * (futures_price - position['futures_entry_price'])

# 計算平倉手續費

spot_close_commission = position['spot_quantity'] * spot_price * 0.001

futures_close_commission = position['futures_quantity'] * futures_price * 0.0004

total_pnl = spot_pnl + futures_pnl - spot_close_commission - futures_close_commission

# 釋放資金

released_capital = position['total_cost'] + total_pnl

self.available_capital += released_capital

# 記錄平倉交易

trade_record = {

'timestamp': datetime.now(),

'action': 'close_arbitrage',

'symbol': symbol,

'type': position['type'],

'spot_price': spot_price,

'futures_price': futures_price,

'quantity': position['spot_quantity'],

'spot_pnl': spot_pnl,

'futures_pnl': futures_pnl,

'total_pnl': total_pnl,

'return_rate': total_pnl / position['total_cost'],

'holding_period': (datetime.now() - position['entry_time']).total_seconds() / 3600 # 小時

}

self.trade_history.append(trade_record)

# 移除倉位

del self.positions[symbol]

return True, f"成功平倉 {symbol} 套利倉位,損益: ${total_pnl:.2f}"

def calculate_unrealized_pnl(self, symbol, current_spot_price, current_futures_price):

"""計算未實現損益"""

if symbol not in self.positions:

return 0

position = self.positions[symbol]

# 計算當前損益

spot_pnl = 0

futures_pnl = 0

if position['spot_action'] == 'buy':

spot_pnl = position['spot_quantity'] * (current_spot_price - position['spot_entry_price'])

else:

spot_pnl = position['spot_quantity'] * (position['spot_entry_price'] - current_spot_price)

if position['futures_action'] == 'sell':

futures_pnl = position['futures_quantity'] * (position['futures_entry_price'] - current_futures_price)

else:

futures_pnl = position['futures_quantity'] * (current_futures_price - position['futures_entry_price'])

total_unrealized_pnl = spot_pnl + futures_pnl

return total_unrealized_pnl

def get_performance_summary(self):

"""獲取績效總結"""

if not self.trade_history:

return {}

closed_trades = [trade for trade in self.trade_history if trade['action'] == 'close_arbitrage']

if not closed_trades:

return {'message': '尚無完成的套利交易'}

total_pnl = sum(trade['total_pnl'] for trade in closed_trades)

total_return = total_pnl / self.initial_capital

winning_trades = [trade for trade in closed_trades if trade['total_pnl'] > 0]

win_rate = len(winning_trades) / len(closed_trades)

avg_return = np.mean([trade['return_rate'] for trade in closed_trades])

avg_holding_period = np.mean([trade['holding_period'] for trade in closed_trades])

return {

'total_trades': len(closed_trades),

'winning_trades': len(winning_trades),

'win_rate': win_rate,

'total_pnl': total_pnl,

'total_return': total_return,

'avg_return_per_trade': avg_return,

'avg_holding_period_hours': avg_holding_period,

'available_capital': self.available_capital,

'active_positions': len(self.positions)

}

# 套利策略範例執行

async def run_arbitrage_example():

"""運行套利策略範例"""

strategy = ArbitrageStrategy(initial_capital=100000)

# 模擬市場數據

market_scenarios = [

# 場景1: 期貨溢價過高,正向套利機會

{

'spot_price': 50000,

'futures_price': 50300, # 0.6% 溢價

'funding_rate': 0.0001

},

# 場景2: 價差收斂,平倉機會

{

'spot_price': 50100,

'futures_price': 50150, # 0.1% 溢價

'funding_rate': 0.0001

},

# 場景3: 期貨貼水,反向套利機會

{

'spot_price': 49000,

'futures_price': 48700, # -0.61% 貼水

'funding_rate': -0.0002

}

]

print("期現套利策略模擬:")

print("=" * 50)

for i, scenario in enumerate(market_scenarios, 1):

print(f"\n場景 {i}:")

print(f"現貨價格: ${scenario['spot_price']:,}")

print(f"期貨價格: ${scenario['futures_price']:,}")

print(f"資金費率: {scenario['funding_rate']:.4%}")

# 識別套利機會

opportunity, basis_info = await strategy.basis_monitor.identify_arbitrage_opportunity(

'BTCUSDT',

{'price': scenario['spot_price']},

{'price': scenario['futures_price'], 'funding_rate': scenario['funding_rate']}

)

print(f"基差率: {basis_info['basis_rate']:.4%}")

print(f"調整後基差率: {basis_info['adjusted_basis_rate']:.4%}")

if opportunity:

print(f"套利機會: {opportunity['type']}")

print(f"預期收益率: {opportunity['expected_return']:.4%}")

# 執行套利

success, message = await strategy.execute_arbitrage(

'BTCUSDT', opportunity, scenario['spot_price'], scenario['futures_price']

)

print(f"執行結果: {message}")

# 顯示當前倉位狀態

if 'BTCUSDT' in strategy.positions:

position = strategy.positions['BTCUSDT']

unrealized_pnl = strategy.calculate_unrealized_pnl(

'BTCUSDT', scenario['spot_price'], scenario['futures_price']

)

print(f"未實現損益: ${unrealized_pnl:.2f}")

else:

print("無套利機會")

print(f"可用資金: ${strategy.available_capital:,.2f}")

# 顯示最終績效

print("\n" + "=" * 50)

print("績效總結:")

performance = strategy.get_performance_summary()

if 'message' in performance:

print(performance['message'])

else:

print(f"總交易次數: {performance['total_trades']}")

print(f"勝率: {performance['win_rate']:.2%}")

print(f"總損益: ${performance['total_pnl']:.2f}")

print(f"總收益率: {performance['total_return']:.2%}")

print(f"平均持倉時間: {performance['avg_holding_period_hours']:.1f} 小時")

# 執行範例

await run_arbitrage_example()

class DynamicHedgeRatioArbitrage:

"""動態對沖比例套利"""

def __init__(self):

self.hedge_ratios = {}

def calculate_optimal_hedge_ratio(self, spot_returns, futures_returns, lookback_period=30):

"""計算最優對沖比例"""

# 使用最小方差對沖比例

# h* = Cov(ΔS, ΔF) / Var(ΔF)

if len(spot_returns) < lookback_period or len(futures_returns) < lookback_period:

return 1.0 # 預設1:1對沖

recent_spot = spot_returns[-lookback_period:]

recent_futures = futures_returns[-lookback_period:]

covariance = np.cov(recent_spot, recent_futures)[0, 1]

futures_variance = np.var(recent_futures)

if futures_variance == 0:

return 1.0

optimal_ratio = covariance / futures_variance

# 限制對沖比例在合理範圍內

optimal_ratio = max(min(optimal_ratio, 1.5), 0.5)

return optimal_ratio

def adjust_position_sizes(self, spot_quantity, optimal_hedge_ratio):

"""調整倉位大小"""

futures_quantity = spot_quantity * optimal_hedge_ratio

return {

'spot_quantity': spot_quantity,

'futures_quantity': futures_quantity,

'hedge_ratio': optimal_hedge_ratio,

'hedge_effectiveness': min(optimal_hedge_ratio, 1.0)

}

class MultiLegArbitrage:

"""多腿套利策略"""

def __init__(self):

self.active_strategies = {}

async def calendar_spread_arbitrage(self, near_month_price, far_month_price,

near_expiry_days, far_expiry_days):

"""日曆價差套利"""

# 計算年化收益率差異

near_annual_rate = np.log(near_month_price / far_month_price) * (365 / (far_expiry_days - near_expiry_days))

# 如果遠月合約相對便宜,做多遠月做空近月

if near_annual_rate > 0.1: # 10% 年化差異

return {

'strategy': 'calendar_spread',

'action': 'long_far_short_near',

'near_action': 'sell',

'far_action': 'buy',

'expected_convergence': near_annual_rate

}

elif near_annual_rate < -0.1:

return {

'strategy': 'calendar_spread',

'action': 'long_near_short_far',

'near_action': 'buy',

'far_action': 'sell',

'expected_convergence': abs(near_annual_rate)

}

return None

async def cross_exchange_arbitrage(self, exchange_prices):

"""跨交易所套利"""

opportunities = []

exchanges = list(exchange_prices.keys())

for i in range(len(exchanges)):

for j in range(i + 1, len(exchanges)):

exchange_a = exchanges[i]

exchange_b = exchanges[j]

price_a = exchange_prices[exchange_a]['price']

price_b = exchange_prices[exchange_b]['price']

# 考慮交易成本

cost_a = exchange_prices[exchange_a].get('trading_cost', 0.002)

cost_b = exchange_prices[exchange_b].get('trading_cost', 0.002)

# 計算淨價差

gross_spread = abs(price_a - price_b) / min(price_a, price_b)

net_spread = gross_spread - cost_a - cost_b

if net_spread > 0.003: # 0.3% 最小利潤要求

if price_a > price_b:

opportunities.append({

'type': 'cross_exchange_arbitrage',

'buy_exchange': exchange_b,

'sell_exchange': exchange_a,

'buy_price': price_b,

'sell_price': price_a,

'gross_spread': gross_spread,

'net_spread': net_spread,

'profit_potential': net_spread

})

else:

opportunities.append({

'type': 'cross_exchange_arbitrage',

'buy_exchange': exchange_a,

'sell_exchange': exchange_b,

'buy_price': price_a,

'sell_price': price_b,

'gross_spread': gross_spread,

'net_spread': net_spread,

'profit_potential': net_spread

})

return opportunities

class ArbitrageRiskManager:

"""套利風險管理器"""

def __init__(self, max_position_count=5, max_capital_allocation=0.5):

self.max_position_count = max_position_count

self.max_capital_allocation = max_capital_allocation

self.risk_limits = {

'max_basis_deviation': 0.02, # 2% 最大基差偏離

'max_holding_period': 24, # 24 小時最大持倉時間

'max_individual_loss': 0.05, # 5% 單筆最大損失

'max_daily_loss': 0.10 # 10% 日最大損失

}

def validate_arbitrage_opportunity(self, opportunity, current_positions,

portfolio_value, daily_pnl):

"""驗證套利機會的風險"""

validation_results = {

'approved': True,

'warnings': [],

'rejections': []

}

# 檢查倉位數量限制

if len(current_positions) >= self.max_position_count:

validation_results['approved'] = False

validation_results['rejections'].append('超過最大倉位數量限制')

# 檢查資金分配限制

total_allocated = sum(pos.get('total_cost', 0) for pos in current_positions.values())

allocation_ratio = total_allocated / portfolio_value

if allocation_ratio > self.max_capital_allocation:

validation_results['approved'] = False

validation_results['rejections'].append('超過最大資金分配比例')

# 檢查基差偏離度

if abs(opportunity.get('expected_return', 0)) > self.risk_limits['max_basis_deviation']:

validation_results['warnings'].append('基差偏離度過大,需要謹慎')

# 檢查日損失限制

if daily_pnl < -self.risk_limits['max_daily_loss'] * portfolio_value:

validation_results['approved'] = False

validation_results['rejections'].append('超過日損失限制')

return validation_results

def calculate_position_size(self, opportunity, available_capital, volatility):

"""基於風險計算倉位大小"""

# 基礎倉位大小

base_allocation = 0.2 # 20%

# 根據預期收益調整

return_adjustment = min(opportunity.get('expected_return', 0) * 10, 1.0)

# 根據波動性調整

volatility_adjustment = max(0.5, 1 - volatility * 5)

# 最終倉位大小

final_allocation = base_allocation * return_adjustment * volatility_adjustment

position_size = available_capital * final_allocation

return {

'position_size': position_size,

'allocation_ratio': final_allocation,

'return_adjustment': return_adjustment,

'volatility_adjustment': volatility_adjustment

}

def monitor_position_risks(self, positions, current_prices):

"""監控倉位風險"""

risk_alerts = []

for symbol, position in positions.items():

# 檢查持倉時間

holding_hours = (datetime.now() - position['entry_time']).total_seconds() / 3600

if holding_hours > self.risk_limits['max_holding_period']:

risk_alerts.append({

'type': 'holding_period_exceeded',

'symbol': symbol,

'holding_hours': holding_hours,

'severity': 'medium'

})

# 檢查單筆損失

if symbol in current_prices:

spot_price = current_prices[symbol]['spot']

futures_price = current_prices[symbol]['futures']

unrealized_pnl = self._calculate_unrealized_pnl(position, spot_price, futures_price)

loss_ratio = abs(unrealized_pnl) / position['total_cost']

if unrealized_pnl < 0 and loss_ratio > self.risk_limits['max_individual_loss']:

risk_alerts.append({

'type': 'individual_loss_exceeded',

'symbol': symbol,

'loss_ratio': loss_ratio,

'unrealized_pnl': unrealized_pnl,

'severity': 'high'

})

return risk_alerts

def _calculate_unrealized_pnl(self, position, current_spot, current_futures):

"""計算未實現損益"""

# 實作與之前相同的邏輯

pass

class ArbitrageExecutionOptimizer:

"""套利執行優化器"""

def __init__(self):

self.execution_algorithms = ['market', 'limit', 'iceberg', 'twap']

def optimize_execution_strategy(self, order_size, market_depth, volatility):

"""優化執行策略"""

strategy = {

'algorithm': 'market',

'split_orders': False,

'execution_timeframe': 'immediate'

}

# 根據訂單大小調整

if order_size > market_depth * 0.1: # 訂單超過市場深度10%

strategy['algorithm'] = 'iceberg'

strategy['split_orders'] = True

strategy['chunk_size'] = market_depth * 0.05

strategy['execution_timeframe'] = 'extended'

# 根據波動性調整

if volatility > 0.02: # 高波動性

strategy['algorithm'] = 'limit'

strategy['price_improvement_attempts'] = 3

strategy['timeout'] = 30 # 30秒超時

return strategy

async def execute_arbitrage_orders(self, spot_order, futures_order, execution_strategy):

"""執行套利訂單"""

if execution_strategy['algorithm'] == 'market':

return await self._execute_market_orders(spot_order, futures_order)

elif execution_strategy['algorithm'] == 'limit':

return await self._execute_limit_orders(spot_order, futures_order, execution_strategy)

elif execution_strategy['algorithm'] == 'iceberg':

return await self._execute_iceberg_orders(spot_order, futures_order, execution_strategy)

async def _execute_market_orders(self, spot_order, futures_order):

"""執行市價單"""

# 同時執行現貨和期貨訂單以最小化基差風險

results = await asyncio.gather(

self._submit_spot_order(spot_order),

self._submit_futures_order(futures_order),

return_exceptions=True

)

return self._process_execution_results(results)

async def _execute_limit_orders(self, spot_order, futures_order, strategy):

"""執行限價單"""

# 根據當前買賣價差設定限價

spot_limit_price = spot_order['price'] * (1 + 0.0005) # 小幅改善價格

futures_limit_price = futures_order['price'] * (1 - 0.0005)

# 提交限價單

spot_result = await self._submit_limit_order(spot_order, spot_limit_price)

futures_result = await self._submit_limit_order(futures_order, futures_limit_price)

return self._process_limit_results(spot_result, futures_result, strategy)

今天我們深入學習了期現套利策略的實際應用,就像掌握了在不同市場間買賣農產品的精髓。重要概念包括:

套利策略核心:

實戰要點:

成功關鍵:

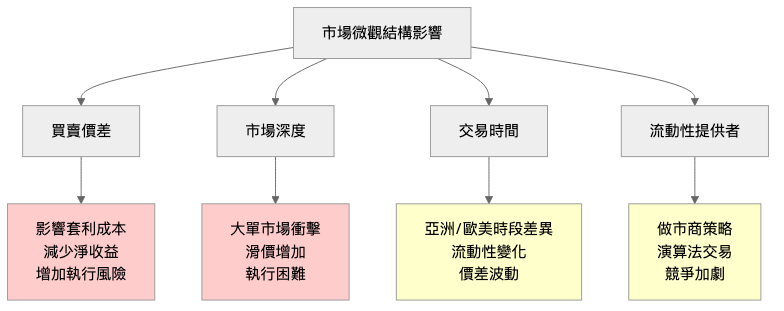

常見挑戰:

記住爸爸做生意的原則:「穩賺不賠的生意不多,但只要細心觀察,總能找到機會」。期現套利雖然看似穩健,但也需要專業的技術和嚴格的風險管理!

明天我們將學習回測系統的建立,為策略驗證打下堅實的基礎。

下一篇:Day 24 - Backtesting